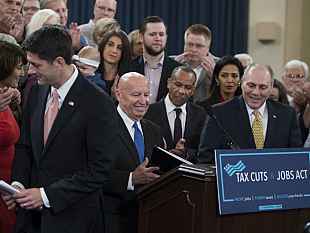

Following the repeated failure of Congressional Republican plans to pass healthcare legislation, all eyes on Capitol Hill have turned to a tax reform agenda that President Trump and GOP lawmakers are now pushing.

Some marijuana policy observers believe the overhaul provides an opportunity for cannabis businesses to finally break free from a 1980s provision — known as 280E — that forces them to pay a much higher tax rate than companies in other industries.

WHAT IS 280E?

Enacted in 1982, Section 280E of the Internal Revenue Code states:

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.

While it was initially intended to stop drug cartel leaders from writing off yachts and fancy cars, today its plain language means that that growers, processors and sellers of marijuana — which is still a Schedule I substance under federal law — can’t take business expense deductions that are available to operators in other sectors.

And it doesn’t matter if they are strictly in compliance with state or local policies. Federal law is federal law.

As a result, cannabis businesses often pay an effective tax rate upwards of 65-75 percent, compared with a normal rate of around 15-30 percent.

HOW 280E REFORM COULD HAPPEN THIS YEAR

Over the past several Congresses, standalone bills to amend the provision so that it doesn’t apply to state-legal businesses have earned increasing numbers of cosponsors, but haven’t received hearings or votes.

Now that a broader tax reform package is on the agenda with the support of Congressional leadership and the White House, advocates and industry operators are pushing to attach a 280E fix to the moving vehicle.

Restricted Analysis For Marijuana Moment Patreon Supporters Only

Learn which five GOP House members and three Democrats cannabis businesses need to target with advocacy efforts to win a key committee vote on 280E reform language.

Plus: See which three GOP senators reformers could pick up key votes from.

(Analysis contains 1,200+ words and an embedded spreadsheet tracking lawmakers’ past marijuana votes).

With support from the targeted House and Senate members named above, cannabis businesses would succeed in attaching 280E reform language to the tax plan at the committee level before the legislation reaches the floor.

THE LOBBYING PUSH

Marijuana business advocacy groups like the National Cannabis Industry Association and the New Federalism Fund are mounting lobbying campaigns to build support for 280E reform on Capitol Hill.

But they aren’t alone. Powerful conservative anti-tax crusader Grover Norquist is also working on the issue. In an interview earlier this year, he said he has “brought it up with leadership” but hadn’t yet gotten solid indications that House Speaker Paul Ryan or other members are on board with the plan.

But that could change if a significant number of GOP members make it clear that fixing 280E is important enough to them that they’d make their support for the overall bill contingent on it.

“Marijuana could get into that [tax reform] package if some of the libertarian Republicans made that a condition of voting for the whole package,” Norquist said.

COMPLICATIONS

In addition to the tough legislative math in House and Senate committees detailed previously, 280E reform advocates may encounter a bigger problem: The deficit.

While rescinding the provision’s application to state-legal cannabis providers is a matter of basic fairness, it would also, on its face, amount to a large tax cut from current rates for those businesses. And that could be a roadblock to success, as Republicans are already struggling to find ways to pay for broader tax cuts they are proposing in the plan.

While most legalization advocates would gladly agree to a federal sales tax on legal marijuana to make up for the 280E fix, the kinds of broader changes needed to existing drug laws seem far beyond the scope of the tax package.

An even simpler pitfall for 280E reform is that even if it is successfully attached to the broader tax legislation, there is no guarantee that the bill will be enacted. Healthcare reform efforts that GOP leaders put a lot of stake and effort into passing have fallen short on several occasions in recent months. Budget proposals necessary for clearing a legislative path for the tax bill to advance have only very narrowly been approved by the House and Senate, meaning that leadership has very few votes to spare when negotiating the finer points of the legislation.

COMPROMISE APPROACHES

If reformers aren’t able to earn enough support for a full 280E carveout for cannabis businesses, there are two potential compromise approaches they may consider.

One would be to push for a reform that only protects medical cannabis, and not recreational marijuana, businesses. While that would certainly leave a significant portion of the industry behind, it may be more palatable to certain lawmakers. GOP Sen. Susan Collins or Maine, for example, said during a 2014 committee debate on a marijuana banking amendment that she would have supported the measure if it only protected medical cannabis businesses. But, because of its broader reach, she voted against it.

Similar concerns led to the complete removal of banking language between last year’s version of the comprehensive Senate medical cannabis bill known as the CARERS Act and this year’s introduction of new legislation, according to marijuana lobbyists.

Another potential compromise, floated by former Joint Congressional Committee on Taxation staffer Pat Oglesby would enact a 280E fix but maintain the non-deductibility of marijuana businesses’ advertising expenses. NORML has signed off on the plan.

TIMING

This will all move fairly quickly. The House bill will be introduced this week, and the Ways and Means Committee is set to begin marking up the legislation on Monday. The Senate will move sometime after that. Lawmakers have said they plan to have a bill on President Trump’s desk by the new year.

OUTLOOK

The chances of attaching a 280E fix to the broader tax reform plan are non-zero, but broader political factors and whip count math mean that it will be far from an easy task.

A serious, targeted and well-funded lobbying effort aimed at four Republican House members, three Democratic House members and three Republican senators is needed to ensure any chance of success.

credit:420intel.com