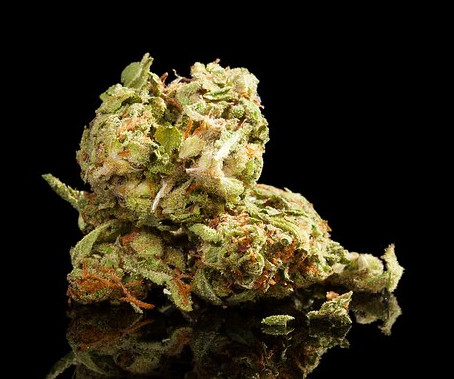

Yesterday, Canada officially became the first major economy and the second country in the entire world (behind Uruguay; who knew?) to legalize marijuana for all uses.

We couldn’t be happier for our neighbors to the north for puff puff passing the legislation — although they probably should’ve waited until 4/20.

The weed-gates have opened…

And the front-runner is a company called Canopy — the first Canadian marijuana grower to debut on the New York Stock Exchange with a valuation of more than $10B.

For perspective on how big the world’s new money-making industry is, according to The New York Times, Canopy is now worth more than Canadian company Bombardier, one of the largest airplane and train manufacturers in the world.

Hell, even big bev is pushing its chips into the marijuana game. Companies like Molson Coors and the maker of Corona (who is reportedly spending $191m to develop weed-infused beverages).

But, some believe the hype is too damn high

Aswath Damodaran, AKA Wall Street’s “Dean of Valuation,” believes pot stocks are inflated, saying none have provided “compelling enough stories” to back up their price tags. Come up with a more compelling nickname then we’ll talk, Aswath.

In the meantime, Mean Dean Damodaran (just throwing out options here) recommends investors “stay out for the moment.”

Oddly enough, as Canada opened its dispensary doors nationwide, pot stocks actually came down — With Canopy and other front-runners Aurora Cannabis and Tilray stock dropping a collective 24.4%.

Credit: thehustle.co