Canopy Growth Corp. (CGC) hasn’t been lit ablaze just yet.

Analysts at Echelon Wealth Partners, one of the few firms that cover the regulated cannabis space, said this week that although Canopy Growth remains an industry leader a wider-than-expected quarterly loss weighs on long-term potential for the stock.

Canopy Growth, which is Canada’s largest cannabis producer based on quarterly revenue, began trading on the New York Stock Exchange in late May. U.S.-listed shares have shed about 6% of their value in the last month, while Canadian shares listed under the ticker “WEED” have fallen about 5% despite that country’s move to legalize recreational weed across the nation late last month.

Echelon rates Canopy Growth as a sell, but this week hiked its price target for Toronto-listed shares to $30 from $22 based on the company’s full acquisition of its BC Tweed joint venture completed Thursday

“While we continue to believe WEED deserves a premium given the company’s market leadership in a number of areas, the stock is now trading at a premium that is high even by its own historical standards,” Echelon said.

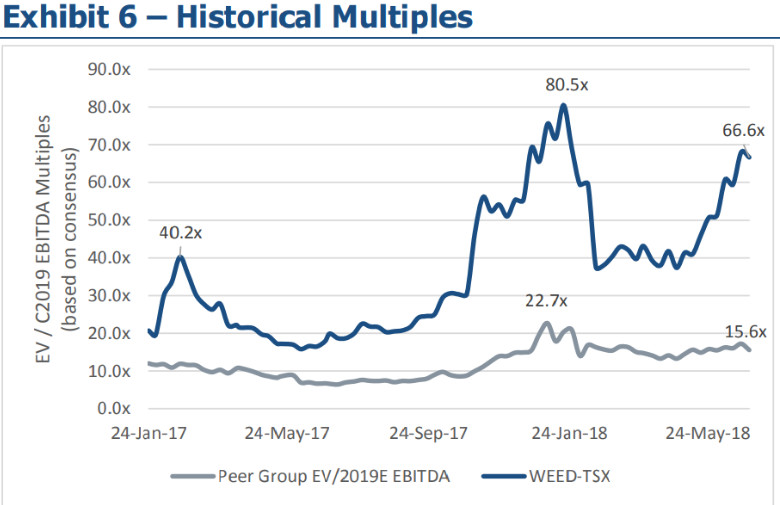

Canopy Growth’s peer group trades on average at about 16.2 times earnings estimates for 2019 based on the consensus forecast. Of that group, companies with more than $1 billion in market value excluding Canopy Growth trade at about 23.2 times earnings. Canopy Growth, however, trades closer to 66.3 times earnings.

“We concede that WEED deserves a multiple premium relative to its peers given it has rapidly built a tradition of market leadership, but its current multiple represents a premium of well over 300%, which is well above the already-difficult-to-rationalize 200% premium that the stock has historically received,” analysts wrote.

Echelon noted that, to date, no Canopy Growth announcement has been as material for the stock’s appreciation as the October 2017 investment the company received from Action Alerts PLUS holding Constellation Brands Inc.

Additionally, Canopy Growth reported financials last week that left Wall Street wanting more. The company tallied $22.8 million in revenue for its fiscal fourth quarter, a figure that came in below both Echelon’s $25.1 million estimate and the consensus $24.2 million estimate. Canopy Growth also reported earnings before interest, taxes, depreciation and amortization of negative $22.9 million, well in excess of the loss of $9 million Echelon expected and the loss of $8.4 million the rest of Wall Street predicted.

Ebitda loss for the fourth quarter widened from the prior quarterly loss of $7.1 million. Toronto-listed Canopy Growth shares closed lower 10% on the downbeat results Friday, June 27.

Source: Echelon Wealth Partners

“It is not unusual for rapidly growing companies to produce Ebitda losses in the ‘early days’ of development, as investments are made in infrastructure to support a higher top line,” Echelon wrote. “However … this Ebitda loss was significantly larger than in prior quarters.”

Still, U.S.-listed shares of Canopy Growth traded higher about 1.5% in premarket trading on Thursday.

Credit: www.thestreet.com