The owner of a successful marijuana dispensary in Southern California was abducted from his Orange County home before being tortured and mutilated by kidnappers who mistakenly believed that he had buried tens of thousands of dollars somewhere in the Mojave Desert.

In central Los Angeles, a 28-year-old employee of a pot shop was left to die in a pool of his own blood, shot by masked men who witnesses saw escaping with a duffel bag full of cash. In South LA, a teenager was shot dead by a dispensary security guard during a botched robbery attempt.

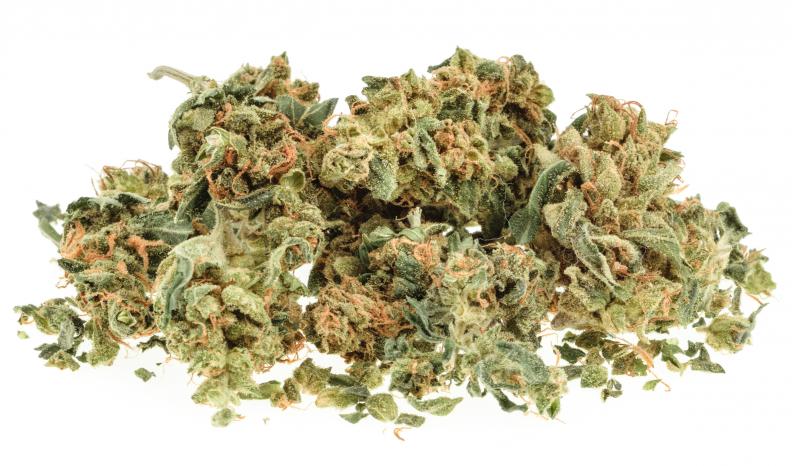

Getting high has become a lucrative legal business in nine American states and the District of Columbia, but legitimate business people continue to face a black-market problem: Where to stash all that money?

Not in a bank. While California has allowed medical for years and fully legalized adult recreational use of marijuana in January 2018, the state’s largest cash crop remains illegal under federal law, which means mainstream banks open themselves up to federal prosecution if they take money from marijuana sales, even in states where it is legal. The result: a large majority of those who work in this multi-billion dollar industry are often forced to deal almost exclusively in cash.

“It is a sad, misfortunate, bad application of public policy,” Aaron Klein, policy director of the Brooking Institution’s Center on Regulation and Markets, told The Daily Beast. “One of the purposes of decriminalizing and legalizing marijuana is to reduce crime.”

MedMen, one of the largest cannabis companies in the world with stores in California, New York and Nevada, recently raised roughly $135 million in venture capital money. Its co-chairman, Chris Leavy, is the former chief investment officer of BlackRock Inc., “the world’s largest money manager,” according to Bloomberg. And yet no national financial institution will touch that money.

“Banking is definitely a challenge for this industry. I think everybody recognizes that,” MedMen spokesperson Daniel Yi said. “As an industry, of course we would like to have access to full banking services, including commercial loans, a line of credit — that’s what every business runs on.”

For now, MedMen relies on one of the few small, local banks and credit unions that will accept what they know to be cannabis cash. Federal regulations still require MedMen’s bankers to file suspicious activity reports regarding their accounts, a compliance cost, and prosecutorial risk, that’s not worth it unless a company is of a decent size. “It gives us a competitive advantage,” Yi admitted, but a mature industry needs lines of credit, not just checking accounts.

Federal policy is unlikely to solve the problem under the current administration. Attorney General Jeff Sessions thinks “good people don’t smoke marijuana.” He started off the year by rescinding Obama-era guidance that had deprioritized the prosecution of state-licensed and compliant marijuana sellers.

In hopes of finding a solution, U.S. Senator Jeff Merkley, a Democrat from Oregon, has introduced a bill, the “SAFE Banking Act,” that would prohibit federal regulators from penalizing financial institutions that do business with state-licensed cannabis firms.

And Senator Elizabeth Warren, a Massachusetts Democrat, has teamed with a Colorado Republican, Cory Gardner, on legislation that would amend federal law so that financial transactions involving legal weed would no longer be flagged as unlawful trafficking. But in a chamber led by Mitch McConnell, a Kentucky Republican who likes industrial hemp but not recreational weed, it’s unlikely the proposed bills will become law.

California, with the world’s fifth biggest economy and its largest cannabis market, has instead started to consider local options.

In June, the California state Senate approved a measure that would allow cannabis-exclusive banks and credit unions to service the marijuana industry, allowing businesses to deposit their cash and write checks.

“Some people don’t like alcohol,” California State Treasurer John Chiang, a centrist Democrat, told The Daily Beast. “Some people don’t like tobacco. Some people don’t like guns. But if you’re going to mainstream a business, you ought to make sure that those businesses operate above board, and part of that is getting an understanding of their financial operations,” he said. “We want to pull the cannabis industry out of the shadow economy.”

Last fall, a working group that Chiang convened issued a report identifying a public, state-owned bank as one of the potential solutions to the marijuana industry’s cash problem. And Chiang said he is preparing to award a contract to examine the obstacles to creating one. State Attorney General Xavier Becerra is weighing the legal hurdles.

But some do not want to wait on Sacramento. In Los Angeles, David Jette, a veteran of the Occupy Wall Street movement and a member of the Democratic Socialists of America, is urging the city to found a public bank of its own, and he has an ally: Herb Wesson, president of the city council, is trying to do just that, and L.A. residents will be asked to vote on the legislation this November.

Residents are being asked to modify the city charter to allow for the existence of a city bank. It would be a watershed moment for public bank advocacy. It’s not the only place where the idea is being discussed, but officials in San Francisco, Seattle and Washington, DC, will be eager to see if the country’s second largest city can even clear the first hurdle: public opinion.

“If the public endorses it, that would be huge for us,” Ellen Brown, a founder and chair of the Public Banking Institute, told The Daily Beast. In 2014, Brown was the Green Party candidate for state treasurer, the creation of a public bank the center of her platform. The likely next governor, Democrat Gavin Newsom, has “long supported creation of state-supported banking solutions for licensed cannabis operators,” according to spokesperson Tammy Trinh, and on Twitter he called for a state bank that would also “build our infrastructure, construct new health care facilities, provide student loans, [and] build 3.5 million new housing units by 2025.”

Public banks come with risks. A federal government opposed to cannabis businesses might see a public bank as an easy target for a raid and subsequent confiscation of deposits. And before even getting to that point the state would probably need a master account at the Federal Reserve, which, at least, is subject to the approval of the San Francisco branch. (In Colorado, a credit union established to service that state’s legal marijuana industry was, after a legal fight, able to obtain conditional approval from the Federal Reserve Bank of Kansas City — but only if it agreed to service marijuana-adjacent businesses, such as accountants and landlords.)

Klein, of Brookings, said federal regulations that make it illegal to do business with state-licensed cannabis firms are counterproductive, even if they are not reliably enforced, would also apply to any bank owned by a state. These rules are “a giant mistake,” he said. “I just don’t see that a public bank solves the core problem.”

Credit: www.thedailybeast.com