Tuesday is Election Day, and New Jerseyans will choose its next governor after eight years of Gov. Chris Christie.

It’s the first time in nearly three decades that a governor in this state served a full two terms. That means the potential for changes and different directions when it comes to the significant issues facing voters, whether it’s property taxes and pensions, or guns and education.

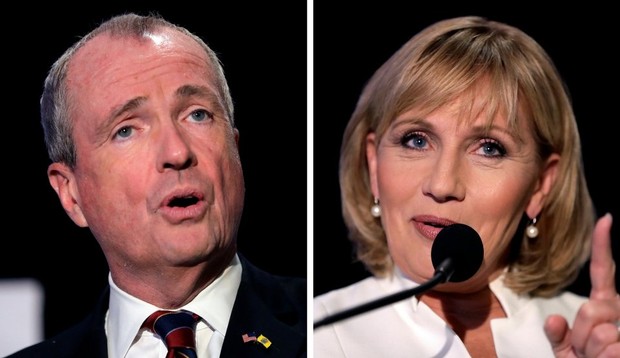

Lt. Gov. Kim Guadagno is the Republican nominee. She’s been lieutenant governor under Christie since 2010 and is former Monmouth County sheriff and a former federal prosecutor.

The Democratic nominee is Phil Murphy, a former U.S. ambassador to Germany, a former finance chair of the Democratic National Committee, and a former Goldman Sachs banking executive.

Here’s where they — and some of the independent candidates — stand on issues that matter to New Jerseyans.

The state’s long-term pension hole is $44 billion — nearly $10 billion more than the state spends on everything in given year.

The hole was dug by politicians from both parties going back a quarter century, and governors over the past decade have failed to stem the tide.

Christie has been gradually increasing annual contributions to the pension fund by one-tenth of the contribution recommended by actuaries. The state will reach the full actuarial recommended contribution in 2023 if it continues on Christie’s timetable. The contribution would be about $6.3 billion.

Guadagno says while the state should honor the commitment it made to the 800,000 people currently in the system, she would “talk responsibly” about making changes for new hires.

She wants to make changes to the public workers’ health care plans to bring them “in line with private sector offerings,” according to her plan. That means she wants to renegotiate the plans to drop them down from so-called Cadillac health insurance status. It’s something Guadagno argues can save the state $2.5 billion.

The problem? would need the help of the state’s Democratic-controlled state Legislature to enact changes.

Murphy has committed to fully funding the state’s pension system. But details on how he would do that have been scant.

He has a plan to raise $1.3 billion by raising taxes on the wealthiest residents, closing corporate tax loopholes and legalizing and taxing marijuana. But to fully fund the pension the state would need billions of dollars of more revenue.

He repeated his claim in the last gubernatorial debate, but again, did not detail how he would pay for it.

“We have a very, very, credible plan to … fully fund the pensions over the next several years as rapidly as possible,” Murphy said. “At least as fast — I hope a lot faster than this administration has been funding them.”

Guadagno noted during the debate that his pension plan sounds a lot like Christie’s.

While there aren’t details of the payment plan, that’s not entirely true. Murphy has also called on the state to divest in private equity and hedge funds embraced by the Christie administration, saying the investments aren’t worth the fees charged to the pension systems.

It’s a mixed bag with the independents and third-party candidates candidates.

Among those who mention pensions on their campaign websites, only independent Gina Genovese, has detailed plan on pension reform.

Her admittedly “small steps” wouldn’t generate the billions needed to right the ship. Genovese proposes reassessing the retirement age and tying cost-of-living increases to continued “residency in New Jersey so retirees are spending their money in the state,” as well as refusing people to collect pensions if they’re working public jobs, meaning they would have to fully retire in order to collect.

The other candidates offer fewer details on digging the state out of the pension hole.

Green Party hopeful Seth Kaper-Dale wants to have a single payer health system for the state, which he says will fix the state’s pension system. But health care is only half of the pension’s woes.

Peter Rohrman, the Libertarian Party nominee, proposes making the “pension system voluntary instead of forcing employees into a bankrupt system.”

Whoever wins will help shape education in a state with 1.3 million students in 691 public school districts — as well as 33 public colleges.

The new administration will also help determine what’s in store for the state’s oft-debated school funding formula, as well as the future of charter school expansion, standardized testing, and graduation requirements — all controversial topics during Christie’s tenure.

Guadagno wants to reform the state’s school funding formula to make sure “millionaires in Hoboken and Jersey City pay their fair share,” according to her campaign. Guadagno plans to direct the state education commissioner to establish an administrative hearing process to develop a record of “whether districts are able to provide a thorough and efficient education and contribute towards educational expenses.” And that record will be used to “uphold the formula in court.”

Guadagno is touting a proposal to cut property taxes for the middle class that will cost a hefty $1.5 billion. And part of the way she’d pay for it is by reducing aid to “overfunded” school districts. School taxes make up the largest portion of New Jersey homeowner’s tax bills.

On school choice, Guadagno told NJ Spotlight in January that, like Christie, she favors charter schools and that she would push ahead with Christie’s plans for private school vouchers, too.

Guadagno also wants to advance merit pay for teachers.

As for higher education, Guadagno wants to train more students in advanced manufacturing, financial services, healthcare, life sciences, hospitality/tourism, technology, and transportation/logistics. She also wants to work with the state’s business community to promote apprenticeship programs, and she wants to expand career and technical education programs. And she wants to freeze tuition and cap fees at public colleges and universities to help families save money.

Murphy has criticized Christie for underfunding the state’s school formula by $9 billion over the last eight years. Instead, Murphy says he wants to fully fund the formula, which would put roughly $1 billion a year more toward education. To help pay for that and other initiatives, Murphy has proposed a $1.3 billion tax hike, raising taxes on wealthy residents, closing corporate tax loopholes, and taxing legalized marijuana.

Murphy also wants to do away with PARCC tests and eliminate standardized testing as a requirement for graduation.

On school choice, Murphy has been skeptical of charter schools. He is calling for a “time-out” on expansions. That falls in line with the views of the New Jersey Education Association, the state’s largest teachers union, which has endorsed Murphy.

As for higher education, Murphy wants to offer tuition-free community college — though he said that plan may not come until later in his tenure, considering how much revenue growth the state sees on his watch.

He also wants increase state aid to colleges and universities to lower tuitions and fees; help forgive loans to students who graduate from science, engineering, and math programs; and institute a state-owned bank to help give out lower-interest student loans.

credit:nj.com