On October 17, 2018, the federal government of Canada legalized the sale and recreational use of cannabis. Here is a brief summary of how sales and excise taxes are being applied to the various cannabis products sold in Canada.

The federal government along with the provincial and territorial governments have agreed to a tax structure to equitably share in the taxing of cannabis. This has been achieved through the Coordinated Cannabis Taxation Agreement(“CCTA”). The duty on cannabis will be shared 25/75 between the jurisdictions. The federal government will be responsible for the collection and enforcement of the taxes under the Act. The province of Manitoba at the time of this article has not signed on to this agreement.

All cannabis products in Canada will be subject to an excise duty (referred to as the “Cannabis Duty”), the Goods and Services Tax/Harmonized Sales Tax (“GST/HST”) as well as any additional provincial retail sales taxes and other fees, duties and/or mark-ups. The legislative authority for the Cannabis Duty is found in the Excise Act, 2001 (“Act”) which is also the same legislation that applies duty rates to alcohol and tobacco products.

To better understand the taxation of cannabis, cannabis is defined as a cannabis plant and any of the following:

- any part of the plant (stem, trim), including phytocannabinoids sourced from the plant whether processed or unprocessed;

- any substance or mixture of substances that contain any part of the plant; and

- any substance that is identical to a phytocannabinoid produced or found in a plant regardless of how it is obtained.

Excluded from Ththis general definition excludes items such as non-viable seed(s) of a cannabis plant, the mature stalk, without leaf, flower, seed or branches, fibre from the mature stalk and the root of the plant. You can find further information in Schedule 1 and Schedule 2 of the Act.

In addition to certain portions of the cannabis plant not being subject to the duty, there are also exemptions from the duty that are detailed in the Act. A summary of these exemptions are plants that are:

- taken for analysis or destroyed by the Minister of National Revenue, or the Minister for the purposes of the Act;

- transferred to another person for analysis or destruction in a manner approved by the Minister;

- a low-THC cannabis product;

- a prescription cannabis drug;

- a prescribed cannabis product or a cannabis product of a prescribed class;

- non-duty paid cannabis products removed from the premises of a cannabis licensee for export in accordance with the Act; or

- a prescribed cannabis product, or a cannabis product of a prescribed class, that is delivered by a cannabis licensee to a prescribed person in prescribed circumstances or for a prescribed purpose.

The Cannabis Duty under the Act that is split 25/75between the federal and provincial governments is similar to the handling of GST/HST. The Cannabis Duty is made up of a federal component referred to as “Duty” and the provincial component is referred to as the “Additional Duty”. These terms and references are important when Licensed Producers are calculating their obligations under the legislation.

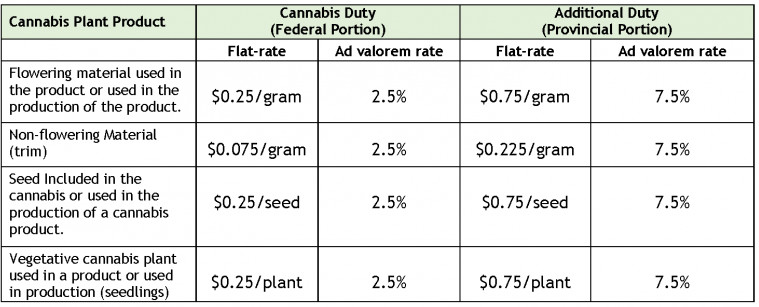

The Cannabis Duty is calculated as either a flat tax amount based on the quantity or volume of cannabis product sold or on an ad valorem (value) amount based on the selling price. The amount of Cannabis Duty to be applied is the greater of these two amounts.

In addition to the 25/75 split of the Cannabis Duty there are certain provinces that have a Sales Tax Adjustment rate applied depending on whether the flat rate or value rate applies to the transaction.

The following chart provides a quick summary of these amounts:

Credit: www.lawnow.org

The provinces that have the Sales Tax Adjustment rate are referred to as listed specified provinces. As of the date of this article the following provinces and rates were provided in the Canada Revenue Agency (“CRA”) Excise Duty Notice EDN55:

- Alberta, 16.8%;

- Nunavut, 19.3%;

- Ontario, 3.9%;

- Saskatchewan, 6.45%.

The calculation of the Cannabis Duty by the Licensed Producers is a rather tricky and somewhat complicated process that the CRA has summarized in 5 steps. If you are a licenced producer you will need to follow these steps. Remember the amount of Cannabis Duty is the greater of the flat rate amount and the value amount; therefore you need to calculate the Cannabis Duty on the product using both methods.

- Determine the flat rate duties both federal and provincial.

- Determine the ad valorem duties both federal and provincial.

- Determine which of the flat rate and ad valorem duties is greater (both federal and provincial)

- Determine the adjustment to additional cannabis duty (provincial) for goods delivered into a listed specified province.

- Determine the final amounts to be reported and remitted on form B300.

The supply of all goods and services made in Canada is subject to the GST/HST at a rate of 5% (13% in ON and 15% in NL, NB, NS and PE) unless the supply is specifically exempted or zero-rated. Currently there are no exempting or zero-rating provisions for cannabis, meaning that all sales of the product (including the excise duties) will be subject to the GST/HST this tax.

British Columbia

The B.C. government will be adding a 15% markup or fee to the cost (landed cost in B.C. excluding the GST/HST) of all cannabis products sold in the province. Cannabis products sold in the province will also be subject to the provincial sales tax of 7%.

Alberta

Alberta will be obtaining additional taxes through the Sales Tax Adjustment (16.8%) calculation as noted above in the Cannabis Duty calculations. At this time Alberta has not made any further announcements or statements on additional taxes or fees.

Saskatchewan

Similar to Alberta, Saskatchewan will receive additional taxes through the Sales Tax Adjustment (6.45%) calculation as noted above in the Cannabis Duty calculations. As well all sales of cannabis in the province will be subject to the retail sales tax at 6%.

Manitoba

Manitoba has taken a very different approach to the taxation of cannabis. They have not opted into the CCTA. Therefore, no additional amounts of Cannabis Duty are collected by the federal government for the province.

Manitoba has instead imposed a $0.75 per gram additional provincial charge but has also impose a 9% tax at the wholesale level of the products and levies an annual 6% “social responsibility fee” to all licenced retailers in the province. There will be no amount of PST levied in addition to these amounts.

Ontario

Similar to Alberta and Saskatchewan, Ontario will obtain additional tax through the use of the Sales Tax Adjustment (3.9%) calculation used when calculating the Cannabis Duty.

Nunavut

In keeping in line with Ontario, Alberta and Saskatchewan, Nunavut will obtain any additional revenues through the Sales Tax Adjustment (19.3%) calculation used when calculating the Cannabis Duty.

Yukon

The Yukon territory, similar to British Columbia, will be adding a markup fee on the landed cost of the cannabis in the jurisdiction and a $0.20 per gram handling fee. The amount of the markup has not been announced as yet.

The remaining provinces and territories in Canada are still in the process of determining if they will chose to levy additional fees or taxes or if they will remain satisfied with the current structure. There may be more details coming in the months that follow.

The calculation of taxes, excises and duties on cannabis products is complicated! If you find yourself needing to understand these requirements, it would be a very good idea for you to consult a professional such as a tax specialist, lawyer or accountant.

Credit: lawnow.org