When the dispensary PharmaCannis submitted its application to meet the June 2015 deadline for New York’s medical marijuana program, the Illinois-based company needed a U-Haul truck to transport 22 boxes that contained 44,000 pages of application materials for one of the most restrictive schemes in the nation.

New York Gov. Andrew Cuomo had signed the bill legalizing the medicinal use of the drug in 2014, and the program required companies seeking a license to submit a $10,000 application fee and a $200,000 check to be refunded if the applicants were not selected.

The state had asked bidders for the location of cultivation facilities, leases for possible dispensaries and how their products would be made. What kind of labels would be on the packaging? What sort of packaging would be used? What sort of soil, fertilizers and nutrients will be used to grow marijuana?

New York state’s Department of Health evaluated the applications of the 43 bidders, which took into consideration the ability to manufacture state-approved products, the moral character and competency of those involved in the company, security and financial standing.

Of those bidders, five were awarded licenses to manufacture and distribute medical marijuana. New York’s program, in contrast to California’s and Colorado’s, did not approve combustible forms of the drug, but only oils, liquids for vaporization and capsules.

“We got the license and I thought the application process was hard. But getting up and running was even harder. There were five weeks of pain with the application and five months of the same ordeal,” said Hillary Peckham, the chief operating officer of Etain, one of the five companies selected. PharmaCannis, also known as PharmaCann, was also among the group.

Since inception, New York has expanded the number of marijuana licenses to five more operators, which resulted in lawsuits against the state and governor from the original licensees, who feared the competition.

In early January, an Albany Supreme Court justice rejected the petition to stop five new companies from manufacturing and dispensing medical marijuana. The state also has expanded the number of medical conditions—including chronic pain and post traumatic stress disorder—that cannabis is approved to treat.

Dozens of lawyers and lobbyists had a role in bringing a legal marijuana industry to New York state. The law firms and lobby shops that were involved in and pushed the rise of medical marijuana are now gearing up for the next frontier: a recreational scheme.

Realization of such regulatory work in the Empire State could take at least three to five years, marijuana experts said, and any move could draw greater scrutiny from some in the Trump administration who are against further expanding state legalization, such as U.S. Attorney General Jeff Sessions.

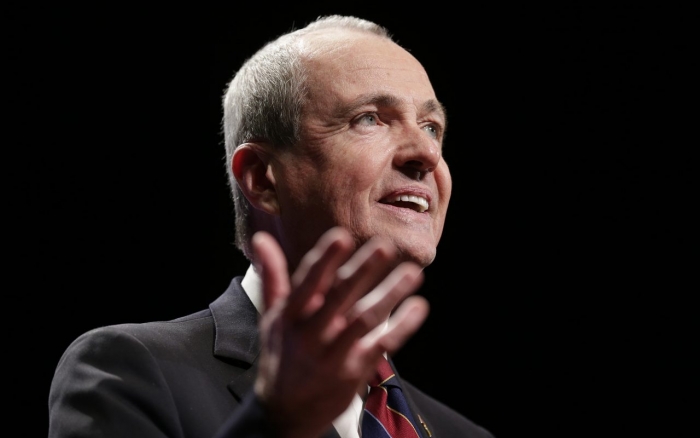

Like other states where marijuana already has become a multimillion industry, however, New York has vowed to push back against any attempt by the federal government to turn back the clock on legalization. In fact, Cuomo, along with newly elected New Jersey Gov. Phil Murphy, seem poised to double down on it.

In January, Cuomo proposed funding a state government panel to study the impact of legalizing marijuana for recreational use in New York in light of surrounding states, including Massachusetts and Vermont, legalizing recreational use.

The latest version of the state’s financial plan released in mid-January shows that revenue from medical marijuana sales is increasing after a very slow start. The updated financial plan released by the state’s Division of the Budget shows that New York now projects $2 million in annual revenue from the 7 percent excise tax on medical marijuana sales. That figure is up from the $1 million revenue projection the state had anticipated through the 2022 fiscal year.

The New York Department of Taxation and Finance has collected $1.24 million in the first nine months of the current fiscal year, which began in April 2017, meaning that the five companies authorized to grow and sell the drug in New York made sales of roughly $17.7 million.

Colorado, by comparison, where medical and recreational use are legal, received $247 million in tax and fee revenue from legal marijuana last year, according to its revenue department.

NEARLY $2 MILLION IN LOBBYING

In the years leading up to medical marijuana legalization and the years that followed, the 10 companies that ultimately won licenses from the state to distribute medical cannabis spent about $1.8 million in lobbying fees, according to a review of lobbying disclosures by the state’s Joint Commission on Public Ethics. [See chart at bottom.]

Park Strategies LLC, the lobbying firm established by former Republican U.S. Sen. Al D’Amato, for instance, alone raked in $186,667 lobbying on behalf of Los Angeles-based MedMen, formerly known as Bloomfield Industries.

Ultimately, the five companies who were initially granted licenses to grow and distribute medical marijuana created their own industry association, New York Medical Cannabis Industry Association, to lobby lawmakers for expansion of the conditions treatable with marijuana, and against the need for additional licensees, arguing that the initial five companies had enough marijuana product and additional growers could cannibalize the already ailing industry.

Along with hiring well-seasoned lobbyists in the Capitol, marijuana companies also hired local and national law firms to help navigate the regulatory and litigatory minefield of a new industry that is still federally forbidden.

Several out-of-state companies that applied to operate medical marijuana businesses hired New York-based law firms that are familiar with the state’s legal and regulatory framework. PharmaCann, for instance, hired Albany-based business firm Harris Beach, whose duties, among others, included traveling to a small, northern Orange County town’s planning board meeting to ensure that it approved PharmaCann’s proposal to establish a medical marijuana facility in the community.

One humid September night in 2015, Mitchell Pawluk, a lawyer for Harris Beach made the trip to Hamptonburgh, a town with a population of less than 6,000 and without its own police force, to assuage residents’ concerns about the safety and security of a new manufacturing facility. The need for that kind of reassurance is one reason that PharmaCann hired a local firm, general counsel Jeremy Unruh said.

“For an out-of-state company that’s coming to New York state, legal advice and local counsel is essential. Established cannabis companies coming to New York are already well-versed in federal law,” Unruh said in a phone interview.

Pawluk said that “local counsel brings value in the areas of understanding New York’s regulatory structure, real estate transactions, corporate formation, strategy, and understanding the local communities companies hope to join. For these reasons, cannabis companies are not seeking single attorneys, but specialized multidisciplinary teams to meet their needs,” in a telephone interview.

RISKY BUSINESS

As in other states, headaches for would-be and actual marijuana entrepreneurs arise from conflicts between federal and state laws regarding marijuana.

“It’ll come down to the feds. Banks are multinational and multistate and they don’t want to take the [marijuana] money,” said Adam Dolan, an associate at Goldberg Segalla in White Plains. The banking industry “is going to take a while” to warm up to the idea of revenue from marijuana, especially because the Trump administration has put in place policies that are “anti-marijuana,” Dolan added.

Because big banks are fearful, it has mainly fallen to credit unions and small, state banks to receive revenue from marijuana, he said.

If that weren’t enough, moving marijuana across state and international borders in commerce can also expose business operators and employees to legal risks. For instance, state prosecutors in Minnesota have charged Dr. Laura Bultman and Ronald Owens, the former chief medical officer and ex-security officer of Vireo Health, a medical marijuana dispensary with offices in New York and a few other states, with felony drug smuggling for transporting cannabis oil 1,200 miles across state lines from its headquarters in Minnesota to New York in 2016.

Paul Engh, Bultman’s attorney, disputes that Minnesota’s marijuana law bans shipping the drug across state borders, according to The Journal News of Westchester. The judge overseeing the case is considering a second motion to dismiss, a spokesman for Vireo said. Calls to the attorney about this matter were not returned by deadline.

Cases like this could crop up more often in the 28 states with legal marijuana programs as a result of Sessions’ recent rescission of the Cole memo. The discrepancies between state and federal laws could expose businesses and users to criminal and civil liabilities even in states and cities where recreational or medical use is allowed..

Though the Cole memo was rescinded, the U.S. Department of Justice is temporarily prohibited from spending any federal funding on prosecuting marijuana-related activities allowed under state law, due to the Rohrabacher-Blumenauer Amendment. The amendment, co-sponsored by Rep. Earl Blumenauer of Oregon and Rep. Dana Rohrabacher of California, extended the protection through Feb. 8 as part of the emergency funding bill passed in Congress in early January.

But by his actions, Sessions effectively gave the legal marijuana debate urgency, experts said. Bryan Meltzer, a partner at boutique law firm Feuerstein Kulick who advises marijuana industry clients, argues that it’s still up to the states’ U.S. attorneys whether they want to prosecute marijuana operators who are abiding by state laws.

“If anything, it’s created this backlash where [marijuana] has become a political issue,” Meltzer said.

Several state lawmakers in New York have called on the federal government to enact legislation that would legalize medical marijuana at the federal level. The architects of New York’s medical marijuana program, state Sen.

Diane Savino of Staten Island and Assemblyman Richard Gottfried of Manhattan, both Democrats, immediately asked for Congress to pass legislation protecting medical programs throughout the country. U.S. Rep. Elise Stefanik, a Republican who represents northern New York, said she is considering a legislative fix to allow states to continue their medical marijuana program.

In New York, Assembly Speaker Carl Heastie said there are criminal justice reforms that have to be considered if New York seeks to legalize recreational, adult use of marijuana. Heastie has noted that African-Americans and Latinos account for a disproportionate number of marijuana arrests although they and white people use marijuana at similar rates.

WHAT’S NEXT?

“As of this date, I am unconvinced on recreational marijuana,” Cuomo said in February 2017, but things seem to be changing quickly. New York may be pushed toward legalizing recreational because of the surrounding states that either have a recreational program in place or are considering it.

But in mid-January of this year he said, “if it was legalized in Jersey and it was legal in Massachusetts and the federal government allowed it to go ahead, what would that do to New York, because it’s right in the middle? This is an important topic, it’s a hotly debated topic, pardon the pun, and it’d be nice to have the facts in the middle of the debate once in a while,” Cuomo said during his budgetary address.

Neighboring Massachusetts legalized recreational marijuana in December 2016 following a ballot initiative. The Massachusetts Department of Revenue estimates that taxes on it could rake in between $44 million and $82 million in the next fiscal year. Vermont’s Republican Gov. Phil Scott signed a bill into law in late January that would legalize recreational use of marijuana starting July 1. Newly sworn-in New Jersey governor Murphy, who campaigned legalizing recreational use, has said he’d sign such legislation if it were passed by the state Legislature.

Polling on whether New York should have a recreational marijuana program varies. A poll conducted in July by Siena College shows that New Yorkers are closely divided on adult, recreational use. Forty-nine percent of registered voters polled supported legalizing recreational use of marijuana, while 47 percent opposed it. Younger voters in New York overwhelmingly support legalization, the poll showed, with 68 percent in favor.

By contrast, in November, a poll conducted by Emerson College and commissioned by the Marijuana Policy Project Foundation and the Drug Policy Alliance found 62 percent of New Yorkers approved of legalizing marijuana for adult use. The survey also showed that taxing sales of legal marijuana was a far more popular way of closing the state’s $4.4 billion budget deficit than higher taxes, new tolls or reduced education spending.

Companies already involved in the state’s medical marijuana program said they would want to be considered if the state does expand toward recreational use because they have the infrastructure already in place.

“We’ve already invested an incredible amount of time and energy,” said Unruh. “Why reinvent the wheel? [A recreational program] must be created from this framework that already exists.”